The best business and personal credit card combinations

Editor's Note

While several credit cards work well individually, strategically combining some cards can provide a much better value. Groupings such as the Chase trifecta or Amex trifecta, where you hold three cards in the same rewards program, are obvious examples.

However, small-business owners have even more opportunities to combine cards to maximize value. Even if you don't have a registered limited liability company, your side hustle can qualify you to open business credit cards.

The best personal/business card combinations generally work better together than alone or complement each other to help you diversify your points earning and bonus categories.

Let's discuss our favorite card combos and why they work so well together.

Related: The best business cards

Marriott Bonvoy Business American Express Card and Marriott Bonvoy Boundless Credit Card

Best for: Those looking to earn Marriott Bonvoy elite status.

Why they work together: If you're looking to get a jump on earning top-tier elite status with the Marriott Bonvoy program, one tip is to hold a personal and business credit card from Marriott.

The Marriott Bonvoy Business® American Express® Card offers 15 elite night credits and automatic Gold elite status and has a $125 annual fee (see rates and fees). The Marriott Bonvoy Boundless® Credit Card offers 15 elite night credits as well, and when combining the elite night credits from cards, you'll only need to stay 20 nights to earn Platinum Elite status.

Of course, these cards come with some great benefits beyond the potential for Platinum Elite status — a free night award annually on each (with the potential to earn a second on the Marriott Bonvoy Business Amex) and solid earning rates.

Both cards earn 6 points per dollar spent at Marriott hotels, while the Bonvoy Boundless earns 3 points per dollar spent on dining at restaurants, gas stations and grocery stores (up to $6,000 per year, 1 point per dollar thereafter).

Meanwhile, the Bonvoy Business card earns 4 points per dollar spent at restaurants worldwide and U.S. gas stations, on wireless phone services purchased from U.S. service providers and U.S. purchases for shipping and 2 points per dollar spent on all other eligible purchases.

The Marriott Boundless has a $95 annual fee, so together, both cards cost $220 per year in annual fees.

Related: The best Marriott credit cards

The Business Platinum Card from American Express and American Express Platinum Card

Best for: Luxury travelers who want to maximize their business and personal travel experiences.

Why they work together: While overlapping in some features, these cards offer an unbeatable lineup of luxury travel benefits. You're earning 5 points per dollar spent on flights (on up to $500,000 on the American Express Platinum Card® when booking directly or through American Express Travel®, then 1 point per dollar spent after that) as well as prepaid hotels booked with Amex Travel. The cards also provide access to perks such as Gold elite status with Marriott and Hilton and extensive lounge access. Enrollment is required for select benefits.

While both of these cards offer access to the same collection of Membership Rewards transfer partners (and frequent transfer bonuses), The Business Platinum Card® from American Express's 35% bonus for eligible flights with your selected airline when you Pay with Points for select flights through Amex Travel allows you to lock in a minimum redemption value of 1.5 cents per point and continue to earn miles and status perks on your flights.

Each card has its own impressive welcome offer as well. The Amex Business Platinum offers 200,000 bonus points after spending $20,000 in eligible purchases within the first three months of card membership. With the Amex Platinum, find out your offer and see if you are eligible to earn as high as 175,000 Membership Rewards Points after spending $8,000 on purchases within the first six months of card membership. Welcome offers vary and you may not be eligible for an offer.

Together, these bonuses alone are worth up to $7,500, according to TPG's December 2024 valuations.

Your annual fees will be steeper at $1,790 total — $895 for the personal Platinum (see rates and fees) and $895 for the Business Platinum (see rates and fees).

Related: Reasons why you should have both the personal and business Amex Platinum

Ink Business Preferred Credit Card and Chase Sapphire Reserve

Best for: Maximizing the Chase Ultimate Rewards program.

Why they work together: While the Chase Sapphire Reserve® is undeniably Chase's most premium card offering, it doesn't have the most valuable welcome bonus in the family. That title goes to the Ink Business Preferred® Credit Card, which has a 90,000-point bonus (after spending $8,000 on purchases in the first three months from account opening) worth a whopping $1,845, based on TPG's December 2024 valuations.

However, after successfully applying for the Chase Sapphire Reserve, you can earn 125,000 bonus points after spending $6,000 on purchases in the first three months of account opening.

Combined, the Sapphire Reserve and Ink Business Preferred bonuses will give you 190,000 Ultimate Rewards points, which you can maximize by transferring to one of Chase's travel partners, including World of Hyatt.

The information for the Ink Business Preferred has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The Sapphire Reserve earns 8 points per dollar on all Chase Travel℠ purchases, 4 points per dollar on flights booked directly through the airline, and 3 points per dollar spent on dining purchases. These bonus categories are very broadly defined and have no annual caps or limits, making for potentially lucrative reward earnings.

The Ink Business Preferred also earns 3 points per dollar on your first $150,000 spent annually in select business-friendly categories that include travel, shipping, internet, cable and phone services and eligible online advertising.

The Sapphire Reserve provides many perks for luxury travel, including a statement credit of up to $120 for Global Entry/TSA PreCheck every four years.

Related: Why the Chase Sapphire Reserve and Ink Business Preferred combo is perfect for couples who travel

Marriott Bonvoy Business American Express Card and Marriott Bonvoy Brilliant American Express Card

Marriott Bonvoy Business® American Express® Card: Earn 125,000 Marriott points after spending $8,000 in the first six months. The annual fee is $125.

Marriott Bonvoy Brilliant® American Express® Card: Earn 100,000 Marriott points after spending $6,000 in the first six months. The annual fee is $650 (see rates and fees)

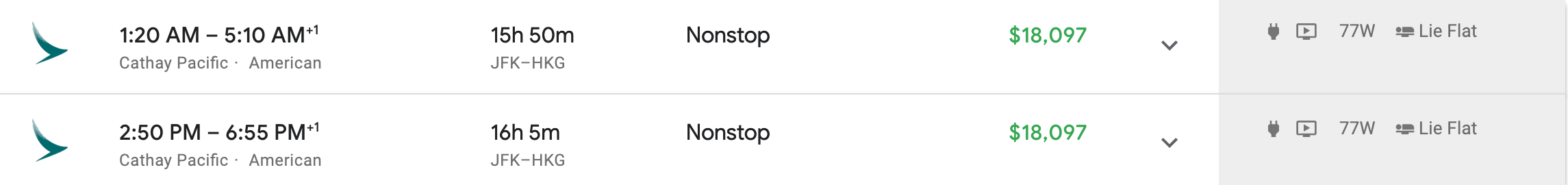

Putting them together: The limited-time elevated welcome bonuses on these Bonvoy Amex cards, valid until Apr. 24, 2019, offer an easy way to quickly and meaningfully boost your Marriott points balance. While either 100,000-point offer will open the door to some high-end hotel redemptions, having 200,000 points gives you access to some much more valuable redemptions. For example, if you transfer 195,000 points to Korean Air it can book you a one-way first-class ticket to Asia on the carrier's 747-8 with a free stopover in Seoul (ICN), while 180,000 points transferred to Alaska will book you a one-way first-class award on either Cathay Pacific or JAL, again with a free stopover in those airlines' hubs.

TPG values Marriott points at 0.9 cents each, so while 200,000 points should be worth about $1,800, you can easily redeem that critical mass of points for 10x as much with airfares on those routes in the $18,000 range.

You'll also find that doubling down on Bonvoy credit cards is a great decision long-term. All of the entry-level Bonvoy cards offer an annual free night certificate worth up to 35,000 points, which is more than enough to justify the $125 annual fee on the Bonvoy Business Amex. If you spend $60,000 a year on the card you'll get a second free night. With the Bonvoy Brilliant, you get a free night worth up to 50,000 points, meaning that these two cards together guarantee you at least two nights in luxury hotels every year.

Both cards earn the same 6x points on Marriott purchases and 2x on everyday spending, so you can switch back and forth as you please. Use your Bonvoy Brilliant for the first $300 you spend at Marriott each cardmember year to trigger your annual Marriott statement credit, then switch to the Bonvoy Business Amex.

You'll get automatic Marriott Gold status with the Bonvoy Brilliant card, and 15 elite night credits each year as well. This makes qualifying for Marriott Platinum status and earning suite upgrades and choice benefits much more attainable, as it lowers the requirement from 50 nights in a hotel each year to 35.

American Express Business Gold Card and Bank of America Customized Cash Rewards credit card

Best for: Those interested in flexible rewards categories.

Why they work together: These two cards have one thing in common — flexible bonus categories.

The American Express® Business Gold Card earns 4 points per dollar spent on the first $150,000 spent annually in the two categories you spend the most in each billing cycle (then 1 point per dollar thereafter). The bonus points are automatically assigned at the end of the billing cycle to the two categories where you spend the most.

The Bank of America® Customized Cash Rewards credit card allows you to earn 6% cash back (for the first year, then 3%) on one of the following categories of your choosing:

- Gas and electric vehicle charging stations

- Online shopping/cable/internet/phone plans/streaming

- Dining

- Travel

- Drugstores/pharmacies

- Home improvement/furnishings

You'll also earn 2% cash back at grocery stores and wholesale clubs. (Note: There is a $2,500 quarterly limit on combined category purchases; you'll earn 1% cash back after reaching this cap).

If you are an existing Bank of America customer, you could earn even more rewards through the Preferred Rewards® program, though this bonus is not applied to the 3% first-year bonus.

Together, these two cards allow you to customize your rewards structure to your specific spending habits, both at home and at the office. Plus, the Bank of America Customized Cash Rewards card has no annual fee, meaning you'll only have to contend with the $375 annual fee on the Amex Business Gold card (see rates and fees).

Related: Is the Amex Business Gold worth the annual fee?

The Blue Business Plus Credit Card from American Express and Chase Sapphire Preferred Card

Best for: Beginners who want to rack up both Membership Rewards and Chase Ultimate Rewards points at a low cost.

Why they work together: Chase Ultimate Rewards and Amex Membership Rewards are two of the most valuable transferable points currencies out there. Still, the top-tier cards for both of these programs cost more than $1,000 in annual fees combined.

The Blue Business® Plus Credit Card from American Express is far and away the best business card for everyday spending, offering 2 points per dollar spent on your first $50,000 in purchases each year (then 1 point per dollar spent thereafter). If you use this for your nonbonus spending and put your travel and dining purchases on the Chase Sapphire Preferred® Card, you can guarantee value out of every purchase you make.

The Sapphire Preferred card is a great choice for earning valuable Chase Ultimate Rewards points on travel and dining purchases.

The best part? The Blue Business Plus has no annual fee (see rates and fees), so together, these cards only cost $95 in annual fees.

Related: How to maximize your rewards earning with the Chase Sapphire Preferred

Bottom line

These are just a few of the most promising business and personal card combinations, but you can tailor these suggestions to meet your own needs. Start with strong building blocks like the Amex Business Platinum or Chase Sapphire Reserve, and look for cards with complimentary perks and bonus categories or cards that can let you diversify into an entirely new rewards currency.

Related: Business cards vs. personal cards: Key differences

For rates and fees of the Business Platinum Amex, click here.

For rates and fees of the Platinum Card, click here.

For rates and fees of the Amex Business Gold, click here.

For rates and fees of the Blue Business Plus Amex, click here.

For rates and fees of the Marriott Bonvoy Business, click here.

For rates and fees of the Marriott Bonvoy Brilliant, click here.